Navigating the world of online trading requires a platform that not only offers robust trading tools but also excels in facilitating seamless financial transactions. Exness, a renowned name in the trading community, stands out for its efficient Exness deposit and withdrawal processes. Whether you are funding your account or cashing out your earnings, the deposit Exness and withdrawal Exness systems are designed to ensure a smooth, hassle-free experience. This introduction will explore the intricacies of these processes, highlighting why Exness is a preferred choice for traders globally.

- Understanding Exness Deposits

- Exness Deposit Methods

- Exness Minimum Deposit

- Exness Micro Account Minimum Deposit

- Exness Standard Account Minimum Deposit

- Exness Deposit Bonus

- How to Deposit Money on Exness

- Navigating Exness Withdrawals

- Exness Withdrawal Methods

- Timeframes for Withdrawal

- Withdrawal Limits and Fees

- Exness Minimum Withdrawal

- How to Withdrawal Money from Exness

- Security Measures for Safe Withdrawals

- Exness Deposit and Withdrawal Problems

- Conclusion

Understanding Exness Deposits

Understanding the deposit process at Exness is crucial for traders who seek a seamless and efficient trading experience. Exness offers a straightforward and user-friendly system for depositing funds, ensuring that traders can quickly and easily add capital to their accounts. This efficiency in the deposit process minimizes downtime and allows traders to capitalize on market opportunities as they arise. The platform provides various methods to accommodate the diverse preferences of its global user base, emphasizing convenience and security in every transaction.

This approach underlines Exness’s commitment to providing a top-tier trading environment where managing financial resources is simple and hassle-free.

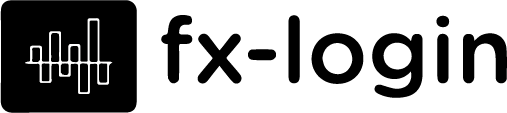

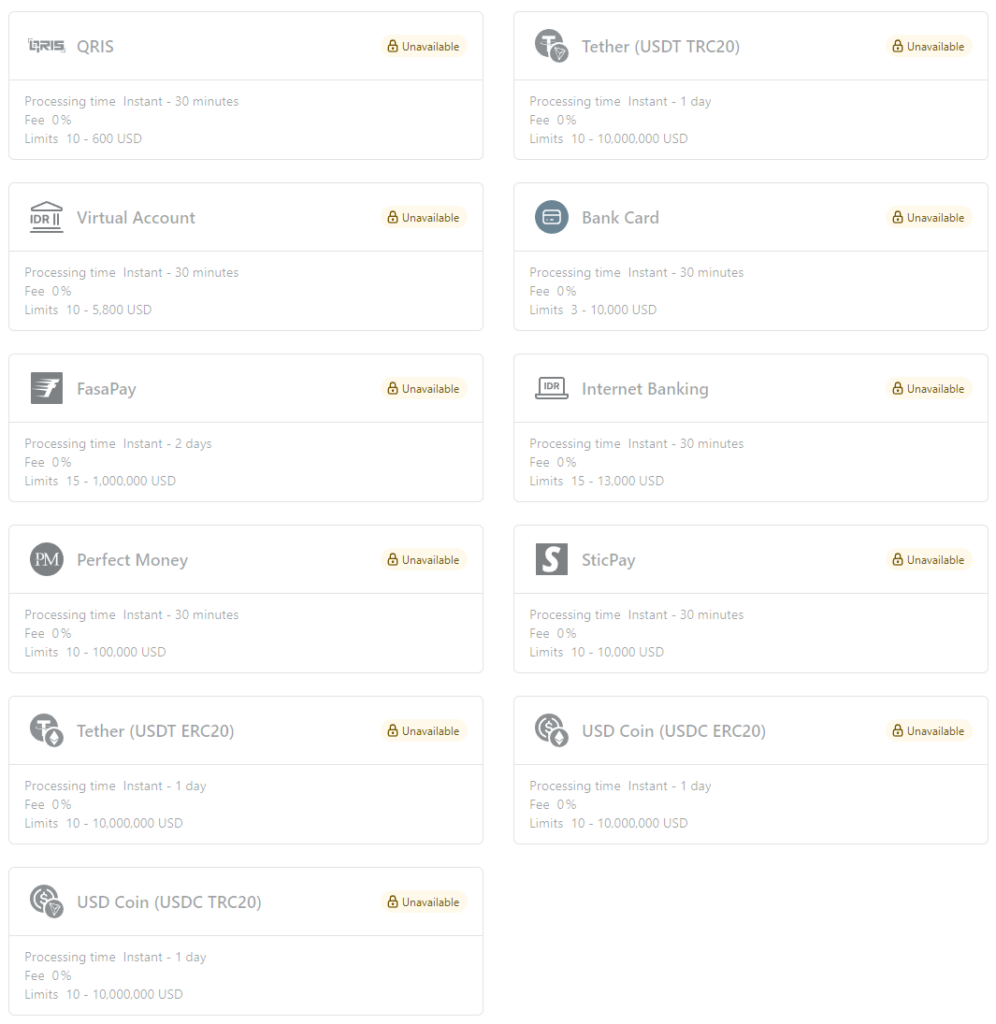

Exness Deposit Methods

When it comes to funding your trading account, Exness provides a diverse range of Exness deposit methods to cater to the needs of traders globally. Among these options, the Exness PayPal deposit stands out as a popular choice for its convenience and security. This introduction explores the flexibility and ease that Exness offers through its various deposit methods, ensuring traders can start their trading journey with ease and confidence.

Exness Minimum Deposit

When you choose Exness as your trading partner, one of the key advantages is the flexibility in funding your account. The Exness broker minimum deposit requirement is designed to accommodate traders of all levels, from beginners to seasoned investors. This approach ensures that the minimum deposit in Exness remains accessible and reasonable, aligning with the platform’s commitment to inclusivity in trading. Furthermore, the Exness deposit rate is structured to offer competitive conditions, empowering traders to start their financial journey with a solid foundation and minimal financial barriers.

Exness Micro Account Minimum Deposit

In the realm of online trading, Exness tailors its services to suit a variety of trader needs, including those seeking a low-entry point. Specifically, the Exness Micro Account stands out for its highly accessible minimum deposit Exness requirement. This feature enables both novice and budget-conscious traders to embark on their trading journey with minimal financial pressure. The micro account option reflects Exness’s commitment to providing flexible and inclusive trading opportunities, allowing traders to start small and expand their portfolio as their confidence and experience grow.

Relevant Article: Exness Account Types

Exness Standard Account Minimum Deposit

The Exness Standard Account offers an appealing entry point for traders, characterized by a manageable minimum deposit for Exness. This account type, ideal for both new and experienced traders, strikes a balance between accessibility and the potential for growth. By setting a reasonable minimum deposit, Exness ensures that traders can participate in the financial markets without the burden of a hefty initial investment.

This approach democratizes access to trading, allowing a broader range of individuals to explore financial opportunities with Exness.

Exness Minimum Deposit in India

Exness tailors its services to meet the specific needs of various regions, and this includes setting a practical minimum deposit for traders in India. The Exness minimum deposit in India is designed to be affordable, allowing Indian traders to start their trading journey without the burden of a high initial investment. This approach demonstrates Exness’s commitment to making trading accessible and inclusive, regardless of the trader’s geographic location or financial background. By offering a low minimum deposit, Exness empowers a broader range of individuals in India to explore the opportunities in the global financial markets.

Exness Minimum Deposit in Nigeria

Exness recognizes the unique financial landscape of different countries, and in Nigeria, it has set a minimum deposit that aligns with local economic conditions. The minimum deposit in Nigeria is structured to be accessible and affordable, allowing Nigerian traders to enter the trading market with ease. This strategic approach reflects Exness’s commitment to inclusivity and its dedication to providing equal trading opportunities to individuals across various regions. By setting a reasonable minimum deposit, Exness ensures that the barriers to entering the global trading arena are lowered for Nigerian traders, fostering a more diverse and dynamic trading community.

Exness Minimum Deposit in South Africa

In South Africa, Exness has tailored its deposit requirements to suit the local currency, making it more convenient for South African traders. The Exness minimum deposit in ZAR is set at an affordable level, ensuring that traders can start their journey in the financial markets without a hefty initial investment. Whether you’re considering the Exness minimum deposit ZAR or looking at the minimum deposit for Exness in ZAR, the amount required is designed to be accessible for a wide range of traders.

This approach highlights Exness’s commitment to inclusivity and its understanding of the diverse economic backgrounds of its users. The Exness ZAR account minimum deposit not only simplifies the process for South African traders but also encourages a broader participation in global trading activities.

Exness Minimum Deposit in Pakistan

Exness has specifically designed its deposit structure to cater to the needs of traders in Pakistan, ensuring that the minimum deposit is both reasonable and accessible. The minimum deposit in Pakistan reflects an understanding of the local economic context, allowing Pakistani traders to engage in global financial markets without facing a prohibitive financial barrier.

This approach underscores Exness’s commitment to inclusivity and its aim to empower traders from diverse economic backgrounds. By offering a low minimum deposit, Exness enables more individuals in Pakistan to participate in trading, fostering a more inclusive and dynamic financial trading environment.

Exness Deposit Bonus

Exness sets itself apart in the trading world by offering an attractive Exness no deposit bonus, designed to welcome newcomers to the platform. This initiative allows traders to dive into the market without the need for an initial deposit, showcasing Exness’s commitment to accessible trading. Additionally, the Exness bonus no deposit provides a fantastic opportunity for new traders to gain real-market experience without financial risk.

Relevant Article: Exness Bonus

For those who decide to fund their accounts, the bonus deposit Exness comes into play, offering additional funds that enhance the trading experience. This strategy not only boosts traders’ confidence but also expands their potential in the trading market. Furthermore, the Exness bonus deposit is a testament to Exness’s dedication to rewarding its users, making it an appealing choice for both novice and experienced traders.

How to Deposit Money on Exness

- Account Registration. Before depositing money, ensure you have an active trading account with Exness. If you’re new, register and complete the necessary verification process.

- Exness Login Deposit. Access your Exness account by logging in. The Exness login deposit procedure begins once you enter your account.

Relevant Article: Exness Login

- Navigating to the Deposit Section. After logging in, navigate to the ‘Deposit’ section, typically found in the dashboard or under the ‘Finance’ tab.

- Selecting the Deposit Method. Exness offers various deposit methods including bank transfers, credit/debit cards, and e-wallets. Choose the one that suits your convenience and availability in your region.

- Entering Deposit Amount. Enter the amount you wish to deposit. Ensure it meets the minimum deposit requirement for your chosen method.

- Completing the Deposit Transaction. Follow the prompts to complete the transaction. This may involve additional steps like verification or redirection to payment service providers, depending on the chosen deposit method.

- Confirmation and Funds Availability. After completing the transaction, you will receive a confirmation from Exness. The deposited funds should be available in your trading account within the specified time frame, based on the deposit method used.

Navigating Exness Withdrawals

Navigating Exness withdrawal processes is a straightforward experience, designed to give traders control over their funds with ease and security. When you decide to withdraw your earnings, Exness ensures that the withdrawal Exness procedure is as smooth as possible. The platform offers various withdrawal methods to suit different needs, allowing for quick access to funds. This commitment to efficient and flexible withdrawals highlights Exness’s dedication to user satisfaction and trust.

Whether you are a seasoned trader or new to the platform, the Exness withdrawal system is structured to provide a hassle-free and reliable way to manage your earnings.

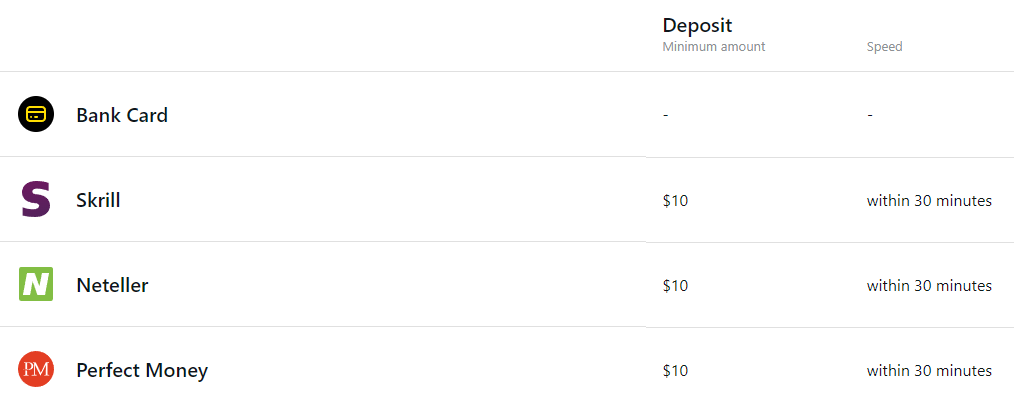

Exness Withdrawal Methods

Exness offers a variety of withdrawal methods to cater to its diverse clientele, ensuring flexibility and convenience in accessing funds. One notable option includes Exness withdrawal to Capitec, a popular choice among traders who use Capitec Bank. This method stands out for its ease of use and efficiency, allowing traders to transfer their earnings directly to their Capitec accounts. Exness’s commitment to providing a range of withdrawal options demonstrates their understanding of different traders’ needs, ensuring that everyone can manage their finances in a way that best suits their personal and trading requirements.

Timeframes for Withdrawal

When it comes to managing your earnings on Exness, understanding the Exness withdrawal period is key. Exness prides itself on offering quick and efficient withdrawal processes. The typical Exness withdrawal time varies depending on the chosen method, but the platform strives to minimize these durations for the convenience of its users. Most traders find that the Exness withdrawal duration is impressively short, allowing them to access their funds promptly. This swift turnaround is part of Exness’s commitment to providing a user-friendly trading experience, ensuring that traders can rely on timely access to their earnings.

Withdrawal Limits and Fees

Understanding the Exness withdrawal limit per day, overall Exness withdrawal limit, and associated Exness withdrawal fees is crucial for traders planning their financial strategies. Exness sets clear limits on how much you can withdraw daily, ensuring a balance between accessibility and security. These limits provide traders with the flexibility to manage their funds effectively while maintaining robust security protocols.

Additionally, Exness maintains transparency regarding Exness withdrawal fees, allowing traders to make informed decisions without unexpected costs. The platform also specifies an Exness maximum withdrawal amount, catering to the needs of both small-scale and high-volume traders. This comprehensive approach to withdrawal limits and fees reflects Exness’s commitment to providing a fair and convenient trading environment.

Exness Minimum Withdrawal

Exness ensures that traders of all levels have the flexibility to manage their funds effectively, particularly with its policy on minimum withdrawals. The Exness minimum withdrawal amount is set to accommodate even small-scale traders, allowing them to access their funds without having to wait for large profits. This policy reflects Exness’s commitment to inclusivity and user convenience, making it easier for traders to maintain cash flow and manage their financial strategies efficiently.

By setting a realistic minimum withdrawal threshold, Exness demonstrates an understanding of the diverse financial situations of its global user base.

Exness Withdrawal South Africa

In South Africa, Exness streamlines the withdrawal process to ensure quick and efficient access to funds for its traders. The Exness withdrawal time in South Africa is optimized to be as swift as possible, allowing traders to receive their funds promptly. This efficiency in processing withdrawals is a significant advantage for South African traders who value speed and convenience.

Additionally, Exness has set a reasonable Exness minimum withdrawal ZAR amount, making it accessible for traders to withdraw their earnings without needing to accumulate a large balance. This approach reflects Exness’s commitment to accommodating the financial needs of its diverse user base, providing a seamless and user-friendly withdrawal experience in the South African market.

Exness Withdrawal India

In India, Exness ensures a smooth and efficient withdrawal process for its traders. The platform has optimized its systems to facilitate quick fund transfers, allowing Indian traders to access their earnings with minimal delay. This focus on efficiency is particularly important in the fast-paced world of online trading, where timely access to funds can be crucial.

Exness understands this need and works diligently to maintain a streamlined withdrawal process in India, ensuring that traders can confidently manage their earnings with ease and convenience. This commitment to a seamless withdrawal experience underscores Exness’s dedication to serving the specific needs of its diverse global clientele.

How to Withdrawal Money from Exness

- Access Your Exness Account. Begin by logging into your Exness account. This is the first step in initiating a withdrawal.

- Navigate to Withdrawal Section. Locate the ‘Withdrawal’ option in your account dashboard. This section is specifically designed for managing fund withdrawals.

- Choose a Withdrawal Method. Exness offers several withdrawal methods. Select one that aligns with your convenience and is available in your region.

- Enter Withdrawal Amount. Specify the amount you wish to withdraw, ensuring it meets the platform’s minimum withdrawal criteria.

- Confirm and Complete Withdrawal. Review all the details, then confirm and submit your withdrawal request. It’s important to ensure all information is accurate to avoid delays.

- Exness Withdrawal Review. After submission, you can track the status of your withdrawal. This is also a good opportunity to write an Exness withdrawal review, sharing your experience about the process and its efficiency, which can be valuable feedback for both Exness and prospective users.

Security Measures for Safe Withdrawals

Two-Factor Authentication (2FA)

Exness enhances withdrawal security through Two-Factor Authentication, requiring users to verify their identity with two separate methods. This significantly reduces the risk of unauthorized access to funds.

SSL Encryption

All withdrawal transactions on Exness are protected with SSL encryption, safeguarding data during transmission. This encryption ensures that sensitive financial information remains secure from potential cyber threats.

Account Verification

Exness mandates a thorough account verification process. This includes providing proof of identity and residence, which helps prevent fraud and unauthorized account activity.

Withdrawal Alerts

Users receive instant notifications for every withdrawal attempt. These alerts enable traders to quickly detect and report any unauthorized or suspicious activity on their accounts.

Compliance with Financial Regulations

Exness adheres to strict financial regulatory standards, which include stringent measures for financial transactions. This compliance ensures a secure and transparent withdrawal process.

Dedicated Fraud Prevention Team

Exness has a dedicated team specializing in fraud prevention, actively monitoring transactions to detect and prevent any fraudulent activities, thus ensuring the safety and integrity of user withdrawals.

Exness Deposit and Withdrawal Problems

While Exness typically provides a smooth trading experience, traders may occasionally encounter Exness deposit problems or Exness withdrawal problems. Common issues can range from delays in processing transactions to difficulties in using certain payment methods. Addressing these Exness withdrawal issues promptly is a top priority for Exness, ensuring that traders can manage their funds effectively without significant disruption.

The platform actively works to identify and resolve any technical glitches or user concerns. Demonstrating their commitment to providing a reliable and efficient trading environment. Exness encourages users to report any problems they face. Allowing for quick resolution and continuous improvement of their deposit and withdrawal systems.

Conclusion

In conclusion, the ability to navigate financial transactions with ease significantly enhances the trading experience on any platform. Exness, with its user-friendly interface and comprehensive range of services, stands out in this regard. The platform not only simplifies the processes of deposits and withdrawals but also ensures security and speed. Catering to the diverse needs of its global user base. Such efficiency and reliability are crucial in the fast-paced world of online trading. Where timely access to funds can make a significant difference. Ultimately, Exness’s commitment to seamless financial transactions plays a pivotal role in its reputation as a trustworthy and efficient trading platform.