In the vibrant world of online trading, Exness stands as a prominent broker, offering a diverse range of account options tailored to meet the needs of different traders. From beginners to seasoned professionals, Exness provides a platform where every trader finds the right tools and conditions to thrive. Understanding these account types is essential for aligning your trading strategies with your financial goals. Let’s explore the unique features and benefits of each Exness account types, ensuring you make an informed choice that best suits your trading journey.

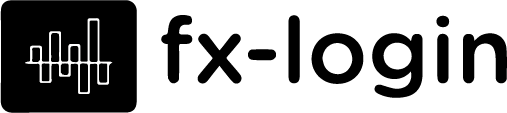

- Exness Professional Account Types

- Exness Pro Account

- Exness Zero Spread Account

- Exness Raw Spread Account

- Exness Standard Account Types

- Exness Cent Account

- Exness Standard Account

- Exness Standard Account Minimum Deposit

- Exness Micro Account

- Exness Micro Account Minimum Deposit

- Exness Islamic Account

- Exness Account Opening

- Exness Account Registration

- Exness Demo Account

- Exness Demo Account MT4

- Exness Demo Account MT5

- Exness Real Account

- Exness Account Login

- Comparing Exness Account Types

- Fees and Commissions

- Leverage Options

- Conclusion

Exness Professional Account Types

For seasoned traders seeking advanced features and tailored trading conditions, Exness offers a range of Professional Account types. These include Raw Spread, Zero, and Pro accounts, each uniquely designed to cater to the sophisticated needs of experienced traders. The Raw Spread account appeals to those who prioritize minimal spreads for fast-paced trading.

Meanwhile, the Zero account stands out for offering zero spread on major currency pairs, ideal for traders focusing on these markets. Lastly, the Pro account represents the pinnacle of professional trading at Exness, providing an extensive range of instruments and optimal trading conditions for those who demand the very best in their trading

Exness Pro Account

The Exness Pro account stands out as a top-tier choice for professional traders who demand excellence in their trading experience. This account type excels in offering a wide array of trading instruments and access to advanced trading tools, enabling traders to execute sophisticated strategies with precision. With the Exness Pro account, traders experience enhanced control over their trades, benefiting from highly competitive spreads and a robust trading environment. Ideal for traders who seek to elevate their trading to the next level, the Exness Pro account is a gateway to unparalleled trading opportunities.

Exness Zero Spread Account

The Exness Zero Spread Account revolutionizes trading for those who prioritize cost efficiency, offering zero spread on major currency pairs. This account type is a game-changer, particularly for traders focusing on high-frequency trading where every pip counts. With the Exness Zero Spread Account, traders enjoy the advantage of trading major pairs without the concern of spread costs eating into their profits. Additionally, the account maintains a transparent and competitive commission structure. Ensuring traders can plan their strategies without hidden fees. The Exness Zero Spread Account thus stands as a powerful tool for traders who aim to maximize their trading efficiency and cost-effectiveness.

Exness Raw Spread Account

The Exness Raw Spread Account is a perfect match for traders who prioritize minimal spreads for their fast-paced trading strategies. This account type offers an edge by providing some of the lowest spreads available, essential for scalpers and day traders who capitalize on small price movements. With the Exness Raw Spread Account, traders experience direct access to market prices, allowing them to execute trades with high precision and speed. This account is especially beneficial for those who require tight spreads to enhance their trading efficiency and improve potential profitability in the volatile world of forex trading.

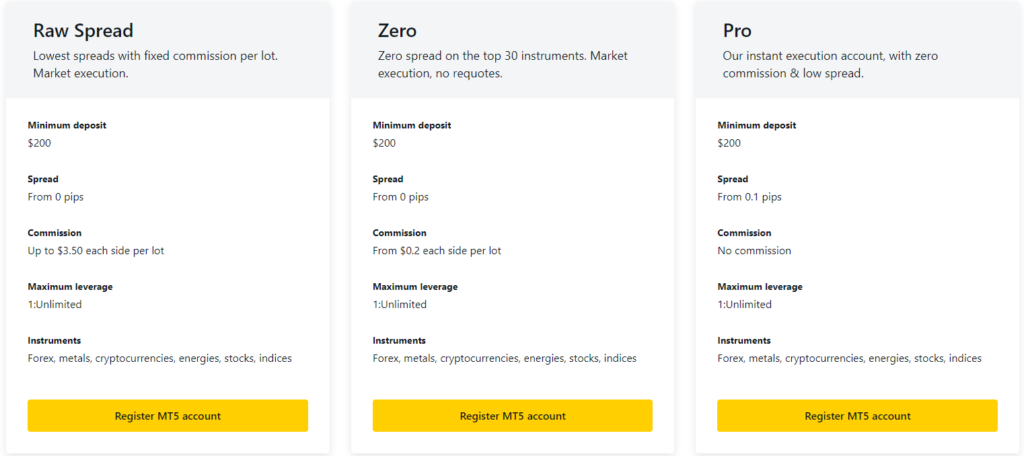

Exness Standard Account Types

Exness Standard Account types cater to traders who seek simplicity and accessibility in their trading journey. These accounts offer a straightforward and user-friendly experience, making them ideal for beginners or those who prefer a no-frills approach to trading. With Exness Standard Accounts, traders enjoy the flexibility of trading with a range of instruments and benefit from competitive spreads. These accounts provide a balanced environment where traders can develop their skills without the complexity of advanced features, making them a great starting point for anyone new to the world of online trading.

Exness Cent Account

The Exness Standard Cent Account offers a unique opportunity for traders to engage in the forex market with significantly reduced risk. This account type is ideal for those starting their trading journey or experimenting with new strategies, as it allows trading in micro-lots. With the Exness Standard Cent Account, traders can gain real-market experience without the need for substantial capital investment. This feature is particularly beneficial for new traders, providing a safe and practical environment to learn and grow. The Exness Standard Cent Account stands as a gateway for traders to explore the forex market dynamics, honing their skills in a low-pressure setting.

Exness Standard Account

The Exness Standard Account stands out as a popular choice for traders who value simplicity and effectiveness in their trading endeavors. This account type offers a straightforward trading experience, making it ideal for beginners or those who prefer an uncomplicated approach. Traders using the Exness Standard Account enjoy the advantage of competitive spreads, a wide range of tradable instruments, and no hidden commissions. This account provides an accessible platform for traders to embark on their trading journey, with enough flexibility to accommodate various trading styles and strategies.

Exness Standard Account Minimum Deposit

The Exness Standard Account sets itself apart with its minimal deposit requirement, making it accessible to a wide range of traders. This feature ensures that traders, regardless of their financial background, can step into the world of trading with ease. The low minimum deposit requirement opens doors for beginners and small-scale traders to start their trading journey without the pressure of a substantial initial investment. This approach democratizes access to the forex market. Enabling more individuals to explore trading opportunities and develop their skills in a practical trading environment.

Exness Micro Account

The Exness Micro Account offers traders the opportunity to enter the forex market with significantly lower capital requirements. This account type is tailored for those who are new to trading or prefer to trade in smaller volumes. With the Exness Micro Account, traders can execute trades in micro-lots, allowing for a more controlled and risk-managed trading experience. It serves as an excellent platform for learning the nuances of the market and testing strategies without the stress of large investments. The Exness Micro Account is a practical choice for those looking to start small and gradually build their trading confidence and expertise.

Exness Micro Account Minimum Deposit

The Exness Micro Account distinguishes itself with a remarkably low minimum deposit requirement. This feature allows traders, especially those new to the forex market or with limited capital, to begin trading without the need for a significant initial investment. The low entry barrier of the Exness Micro Account ensures that trading is accessible to a broader audience, democratizing the opportunity to participate in the forex market. This approach empowers traders to start small, learn the market dynamics, and gradually build their trading strategies and confidence in a real-world trading environment.

Relevant Article: Exness Deposit and Withdrawal

Exness Islamic Account

The Exness Islamic Account caters specifically to traders who require a trading experience compliant with Islamic finance principles. This account type respects the prohibition of Riba (interest) in Islamic law, making it an ideal choice for Muslim traders. The Exness Islamic Account ensures that traders can engage in forex trading without compromising their religious beliefs. It offers a swap-free trading environment where traders do not earn or pay interest on overnight positions. Aligning with Shariah law. This feature makes the Exness Islamic Account a crucial offering. Ensuring inclusivity and respect for diverse financial practices in the global trading community.

Exness Account Opening

Opening an Exness account marks the beginning of a promising trading journey, offering access to a world of trading opportunities. This process is straightforward and user-friendly, designed to welcome traders into the Exness community with ease. Whether you are a novice or a seasoned trader, the Exness account opening procedure guides you smoothly through each step. Ensuring you can start trading as quickly and efficiently as possible. With a range of account types to choose from, Exness tailors the experience to fit your individual trading needs and goals.

Exness Account Registration

Registering for an Exness account is a straightforward process, outlined in a few key steps:

- Visit the Exness Website. Start by navigating to the official Exness website, where you’ll find the option to sign up.

- Choose Your Account Type. Exness offers various account types. Select the one that best fits your trading style and needs.

Relevant Article: Exness Sign Up

- Fill in Personal Details. During the Exness Sign Up process, you’ll be asked to provide personal information such as your name, email address, and phone number. This step is crucial for setting up your account.

- Verify Your Identity. To comply with regulatory requirements, Exness requires you to verify your identity. This usually involves submitting a copy of your ID and proof of address.

- Configure Your Trading Account. Customize your trading account settings, including leverage and platform preferences. This step ensures your account aligns with your trading strategies.

- Fund Your Account. Finally, deposit funds into your account using one of the various payment methods offered by Exness. Once funded, you’re ready to start trading.

By following these steps, you can smoothly complete the Exness Sign Up process and embark on your trading journey with confidence.

Exness Demo Account

The Exness Demo Account serves as an essential tool for both novice and experienced traders. Offering a risk-free platform to practice and refine trading strategies. This account type replicates real market conditions, allowing users to experiment with forex trading without any financial risk. The Exness Demo Account provides virtual funds, enabling traders to test their skills. Understand market dynamics, and learn the nuances of the Exness trading platforms. It’s an invaluable resource for building confidence and competence in trading before transitioning to a live account. Making it a pivotal step in any trader’s journey.

Exness Demo Account MT4

The Exness Demo Account on MT4 provides a dynamic platform for traders to hone their skills in a risk-free environment. This account type allows users to familiarize themselves with the MetaTrader 4 interface. One of the most popular trading platforms in the forex market.

Relevant Article: Exness MetaTrader 4

With the Exness Demo Account on MT4, traders can experiment with various trading strategies. Analyze real-time market data, and learn to use the extensive tools and features offered by MT4. This experience is invaluable for both beginners and experienced traders. Enabling them to practice and perfect their trading techniques without the risk of losing real money.

Exness Demo Account MT5

The Exness Demo Account on MT5 offers traders an advanced platform to practice and perfect their trading skills in a simulated environment. This account type grants access to the cutting-edge features of MetaTrader 5. Allowing users to explore its comprehensive analytical tools and enhanced trading functions.

Relevant Article: Exness MetaTrader 5

With the Exness Demo Account on MT5, traders can experiment with various strategies, utilize advanced charting capabilities, and get accustomed to the sophisticated trading environment of MT5. It’s an ideal solution for those who aim to familiarize themselves with the latest trading technologies and strategies. All while operating in a risk-free setting.

Exness Real Account

Opening an Exness Real Account marks a significant step for traders ready to dive into the live trading world. This process involves a few straightforward steps, ensuring a smooth transition from a demo or practice account. When you open an Exness Real Account, you gain access to the full spectrum of trading instruments, real-time market analysis, and the ability to execute actual trades.

This account type is designed for traders who are ready to apply their strategies in real market conditions and are prepared to manage real financial risks and rewards. By choosing to open an Exness Real Account, you embark on a journey of authentic trading experiences. Backed by a robust platform offering advanced tools and resources to support your trading decisions.

Exness Account Login

Logging into your Exness account is a simple and secure process, which can be completed in just a few steps:

Navigate to the Exness Website. Go to the official Exness website, which is the gateway to your trading dashboard.

Click on the Login Button. On the homepage, find and click the Exness login button. This will direct you to the login page.

Relevant Article: Exness Login

Enter Your Credentials. Input your registered email address or account number and password. These are the credentials you set up during the registration process.

Solve the Security CAPTCHA. For added security, you might be prompted to complete a CAPTCHA challenge. This step ensures that access is being made by a real person and not an automated system.

Access Your Account Dashboard. Once you’ve successfully logged in, you’ll be directed to your Exness account dashboard. Here, you can manage your trades, view account statistics, and access various trading tools.

Troubleshoot Login Issues (if any). If you encounter any issues during the Exness login process, such as forgetting your password, use the provided links for troubleshooting and assistance.

Remember, keeping your login information secure is crucial for protecting your account and financial data. Never share your Exness login credentials with anyone.

Comparing Exness Account Types

Comparing account types is a crucial step in tailoring your trading experience to meet your individual needs and goals. Each account type offers unique features, from spread sizes and leverage options to minimum deposit requirements and available instruments. Understanding these differences enables traders to make informed decisions about which account aligns best with their trading style, experience level, and financial objectives. This comparison not only helps in choosing the most suitable account but also sets the foundation for a more effective and personalized trading strategy.

Fees and Commissions

Understanding fees and commissions is essential in the world of trading, as they directly affect your profitability. Each trading account and platform has its own fee structure, which can include spreads, commissions, and other transactional charges. Spreads refer to the difference between the buying and selling price of an asset, and they can vary based on market conditions and account type.

Commissions are charged based on the volume of trades executed and are typically lower in accounts designed for professional traders. Additionally, traders should be aware of any potential hidden fees, such as inactivity fees or charges for withdrawals and deposits.

It’s crucial to carefully review and compare these costs across different account types to ensure that you choose an option that aligns with your trading strategy and budget.

Leverage Options

Leverage is a powerful tool in trading, amplifying both potential profits and losses. Here are key points to understand about leverage options:

- Definition of Leverage. Leverage in trading means using borrowed funds to increase potential returns on investment. It allows traders to open larger positions with a smaller amount of actual capital.

- Variability Across Accounts. Different account types offer varying levels of leverage. For instance, professional accounts might offer higher leverage compared to standard accounts. Catering to experienced traders who can handle greater risks.

- Impact on Trading Strategy. Your trading strategy should align with your leverage choice. Higher leverage can lead to significant gains but also increases the risk of substantial losses.

- Risk Management. It’s crucial to employ strict risk management strategies when using leverage. This includes setting stop-loss orders and only using a portion of your available leverage to maintain control over the risk.

- Regulatory Limits. Be aware of regulatory limits on leverage, which can vary depending on the region and the type of financial instrument you are trading.

Understanding and carefully selecting leverage options is vital for effective and responsible trading, aligning with your risk tolerance and trading objectives.

Conclusion

In conclusion, choosing the right account type and understanding the associated fees, commissions, and leverage options are key factors in crafting a successful trading strategy. Each trader has unique needs and goals, and the variety of accounts offered by Exness caters to this diversity. By carefully considering these aspects, traders can select an account that best aligns with their trading style and financial objectives. Ultimately, informed decisions in these areas lay the foundation for a more effective, efficient, and rewarding trading experience. Remember, successful trading is not just about making the right moves in the market. But also about choosing the right tools and conditions to support those moves.